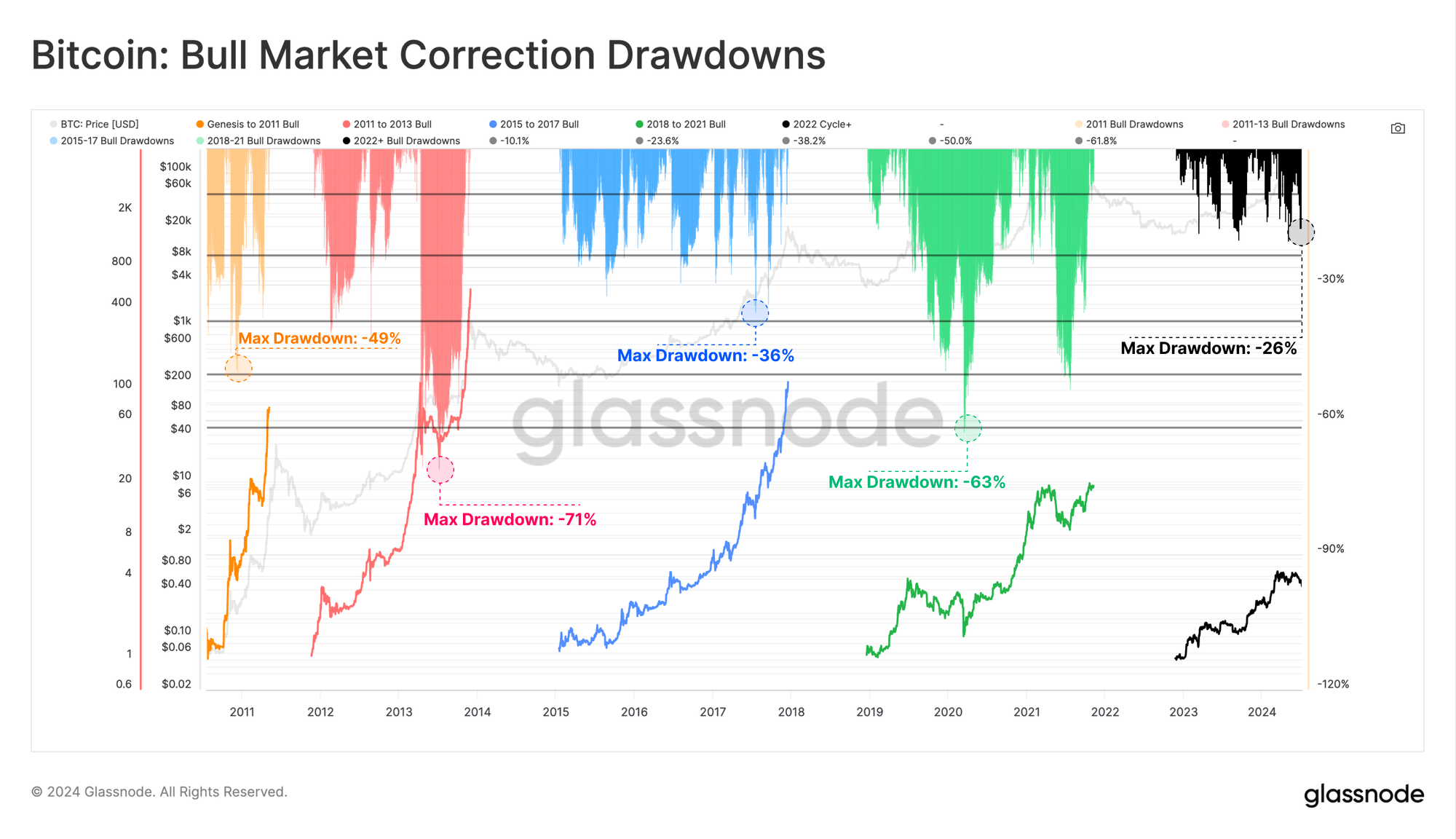

Bitcoin has seen its sharpest decline in the current cycle, trading more than 26% below its all-time high (ATH), as reported by onchain analysis firm Glassnode. This downturn has notably impacted short-term holders, with over 2.8 million BTC now below their purchase price.

Bitcoin Market Faces Significant Drawdown, Glassnode Reports

Despite the downturn, Glassnode’s analysis reveals that this drawdown is historically shallow compared to previous cycles. Spanning 2023-24, the current market cycle shows similarities and differences to past cycles. Following the FTX collapse, Bitcoin experienced 18 months of steady appreciation before a correction exceeding 26% from its ATH between May and July 2024.

Glassnode states:

Whilst this is meaningful, this downtrend has been notably shallower than previous cycles, highlighting a relatively robust underlying market structure and compression of volatility as Bitcoin matures as an asset class.

Glassnode’s researchers observe a significant influx of new investors since January 2024, driven by the introduction of spot ETFs. However, this demand has leveled off, creating an overhang as fewer long-term holders sell and fewer new buyers accumulate BTC. During the recent sell-off, the volume of BTC held by short-term holders below their acquisition cost surged to over 2.8 million, marking the second instance in the past year where more than 2 million BTC were underwater.

“Although there’s heightened financial pressure among short-term holders, the actual losses locked in have remained relatively restrained relative to the overall market size,” details the Glassnode report.

The report also highlights the ongoing profitability challenge for investors, as the realized profit-to-loss ratio has dropped to a neutral level commonly seen in corrections during bull markets. Glassnode’s data reveals a significant rise in realized losses among short-term holders, totaling around $595 million recently, marking the highest since the low point of the 2022 cycle.

“However, when we measure these Short-Term Holder losses as a percentage of total invested wealth (using the STH Realized Cap), the perspective changes dramatically,” explain Glassnode’s researchers.

The onchain report adds:

On a relative basis, the losses locked in by this cohort remain fairly typical compared to previous bull market corrections.

In summary, the report from Glassnode outlines that despite notable drawdowns in the current market cycle, the overall impact has been relatively muted compared to past cycles. The market demonstrates a resilient structure, with experienced investors sustaining profitability despite downturns. Glassnode’s analysis indicates that while short-term holders face significant financial pressure, the long-term outlook remains cautiously optimistic, contingent upon renewed demand to stabilize prices.